Proven Risk Management Strategies to Protect Your Home and Peace of Mind

Introduction: Why Risk Management Matters for Every Homeowner

Owning a home is a significant investment, both financially and emotionally. However, homes are exposed to a variety of risks-ranging from natural disasters and break-ins to accidents and unexpected repairs. Effective risk management strategies help you anticipate, mitigate, and recover from these threats, preserving your property and peace of mind. This guide provides a comprehensive, step-by-step approach to protecting your home, based on proven strategies and expert recommendations.

Step 1: Assess and Identify Risks Specific to Your Home

The foundation of any risk management strategy is understanding the unique threats your property faces. Begin by conducting a thorough risk assessment:

- Natural Hazards: Consider your home’s location and the risks it brings-earthquakes, floods, hurricanes, wildfires, or tornadoes. Research local hazard maps and consult with local emergency management agencies for risk profiles.

- Human Risks: Identify security threats such as burglary, vandalism, or liability risks like injuries on your property. Review recent crime statistics for your neighborhood and inspect your home’s accessibility to outsiders.

- Structural and Systemic Risks: Regularly inspect your home’s structure, roof, plumbing, electrical systems, and foundation for vulnerabilities. Preventive maintenance is key to avoiding costly surprises down the line [1] .

Document your findings, and revisit your risk assessment at least once a year or after significant changes such as renovations or neighborhood developments [2] .

Step 2: Optimize Insurance Coverage for Comprehensive Protection

Insurance is the cornerstone of risk transfer. An adequate policy shields you from devastating financial losses:

Source: aamcourses.com

- Homeowners Insurance: Ensure your policy covers the full replacement value of your home and possessions. Review coverage limits annually to account for appreciation and inflation.

- Specialized Riders: Evaluate the need for flood, earthquake, or wildfire insurance if you live in high-risk areas. Standard policies often exclude these hazards, so consult your insurer about adding the appropriate riders [1] .

- Liability Protection: Include personal liability coverage for accidents or injuries that may occur on your property. This protects against lawsuits and medical expenses.

To improve your insurance plan, schedule regular reviews with a licensed agent. Bring up any home upgrades, security improvements, or new risks. If you’re unsure about your current coverage, contact your insurance provider and request a detailed policy review. Many companies offer this service at no cost.

Source: dreamlandestate.com

Step 3: Implement Physical Security and Loss Prevention Measures

Physical safeguards reduce the likelihood of property loss and deter criminal activity. These measures also enhance your eligibility for insurance discounts:

- Security Systems: Install monitored alarm systems, surveillance cameras, and motion-activated lighting. Modern systems offer remote monitoring via mobile apps and real-time alerts [3] .

- Locks and Barriers: Upgrade to high-security locks on all entry points and reinforce doors and windows. Consider deadbolts, smart locks, and window bars where appropriate.

- Fire Safety: Equip each floor with smoke detectors and test them monthly. Keep fire extinguishers in accessible locations, especially in the kitchen and garage. Use fire-resistant building materials and maintain clear defensible space if you live in wildfire-prone areas [1] .

- Maintenance: Develop a regular inspection routine for your roof, gutters, foundation, and major systems. Preventive maintenance helps catch issues before they escalate.

If you need professional help, contact licensed local contractors for security assessments or fire safety upgrades. Ask your insurance provider if they offer discounts for specific improvements.

Step 4: Develop and Practice an Emergency Preparedness Plan

Preparation is crucial for minimizing harm and loss during emergencies. A robust plan should include:

- Evacuation Routes: Identify primary and secondary exits from each room. Practice evacuation drills with your household to ensure everyone knows what to do [3] .

- Emergency Supplies: Stockpile non-perishable food, water, first-aid kits, flashlights, batteries, and blankets. Store essential documents and valuables in a secure, fireproof location.

- Communication Plan: Establish contact information for all household members and local emergency services. Decide on a meeting point outside your home and another in your community in case of evacuation.

- Power Outage Preparedness: Consider installing standby generators to maintain essential systems during extended outages.

Visit your local government’s disaster preparedness office or emergency management agency for region-specific guides and free resources. Many communities offer free workshops or downloadable checklists to help you get started.

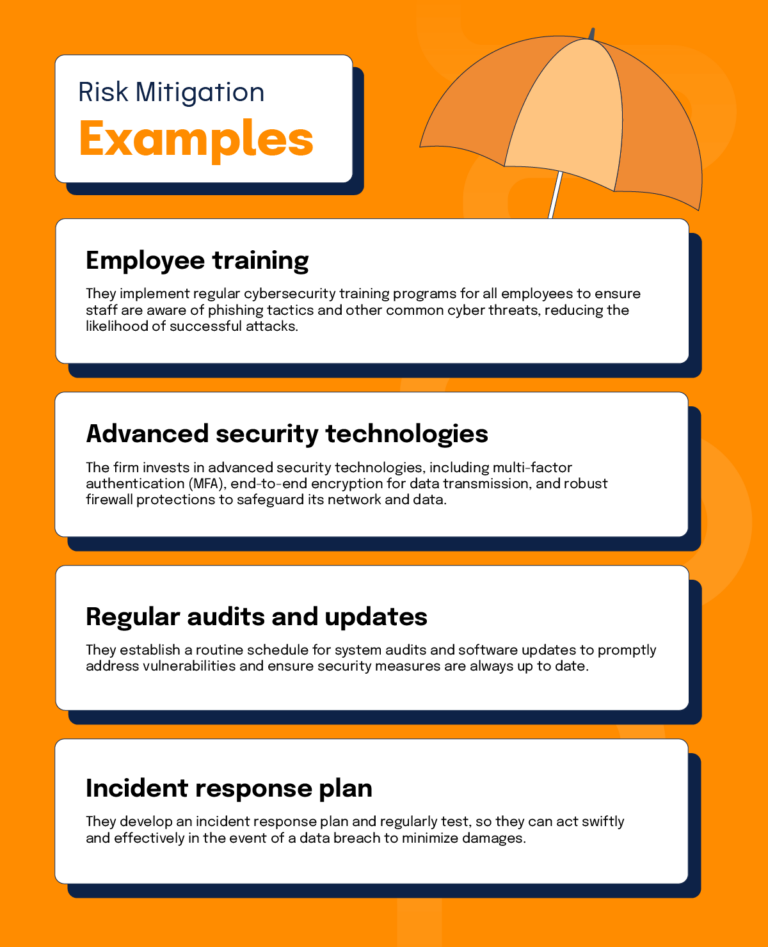

Step 5: Embrace Technological and Cybersecurity Solutions

Modern homes are increasingly connected, making cybersecurity a vital component of risk management:

- Smart Home Security: Use connected security devices for real-time monitoring of your property. Choose reputable brands with robust privacy controls.

- Cybersecurity Measures: Protect home Wi-Fi networks with strong passwords, enable two-factor authentication, and regularly update device firmware. This is especially important for smart locks, cameras, and other IoT devices [3] .

- Data Backup: Store copies of important documents on encrypted drives or secure cloud services. In the event of disaster, you’ll have access to critical information for insurance claims and recovery.

If you need help, consult with an IT professional or visit the official websites of your device manufacturers for security best practices.

Step 6: Regularly Review and Update Your Risk Management Plan

Risk management is not a one-time task. Schedule annual or semi-annual reviews to update your plan as your property, family, or local risks change:

- Review Insurance Annually: Meet with your agent to discuss policy changes, new discounts, or additional coverage needs [2] .

- Update Security Measures: Re-evaluate your home’s vulnerabilities and address any new threats, such as recent neighborhood crime or natural disasters.

- Practice Drills: Ensure all family members are familiar with updated emergency routes and procedures.

Document all updates and keep your risk management plan in an easily accessible location.

Alternative Approaches and Additional Resources

Depending on your needs, you may consider specialized or advanced strategies:

- For high-value or unique properties, consult with risk management professionals or seek services from firms specializing in luxury home protection [3] .

- Property investors should diversify their holdings and conduct due diligence on each property to minimize overall portfolio risk [4] .

- Stay informed about local building codes, zoning laws, and compliance requirements to avoid legal and regulatory risks.

For more help, you can:

- Contact your local government’s emergency management office for region-specific preparedness guides

- Speak with your insurance provider or a licensed risk management consultant for a comprehensive property review

- Join neighborhood watch programs or online community safety forums for real-time alerts and support

Summary: Taking Control of Your Home’s Safety

Protecting your home is about more than just locks and alarms-it requires a comprehensive, ongoing risk management strategy. By assessing risks, optimizing insurance, implementing security measures, preparing for emergencies, leveraging new technologies, and regularly updating your plan, you can significantly reduce your vulnerability to loss. Every home is unique, so tailor these strategies to your situation and consult with professionals as needed. Peace of mind comes from preparation, diligence, and a commitment to continuous improvement.

References

- [1] SZW Insurance (2023). 10 Key Elements of Risk Management for Homeowners.

- [2] Kwik Mortgage (2024). Safeguarding Your Home: Effective Risk Management Strategies.

- [3] Vault Insurance (2024). How to Improve Risk Management for Luxury Homeowners.

- [4] Kew Legal (2025). Comprehensive Guide to Real Estate Risk Management.